基于面板数据的中国股份制商业银行资本效率实证分析(硕士)(论文37000字)

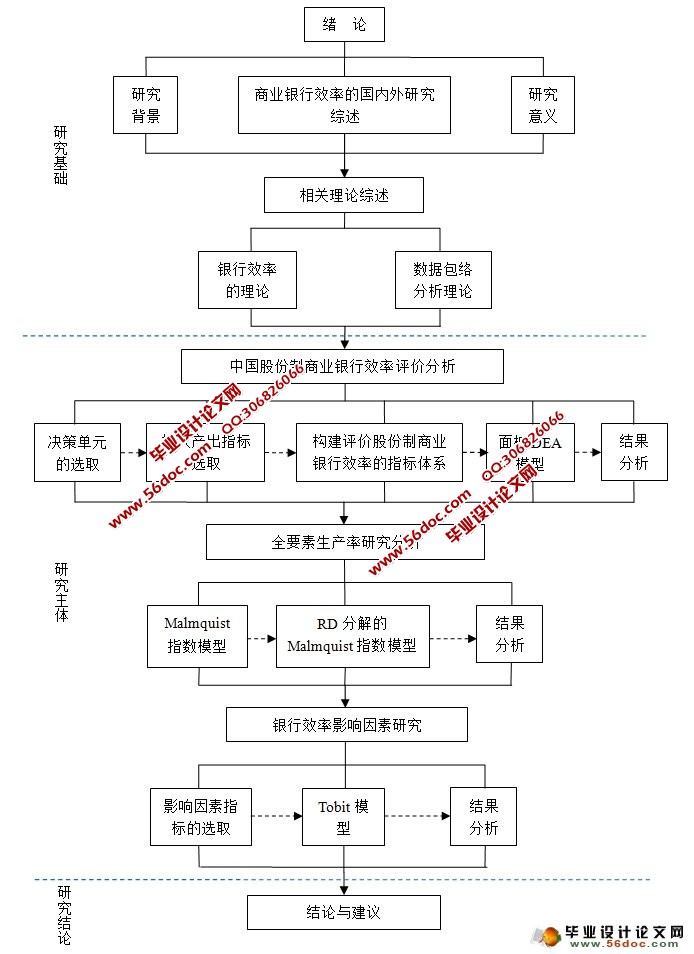

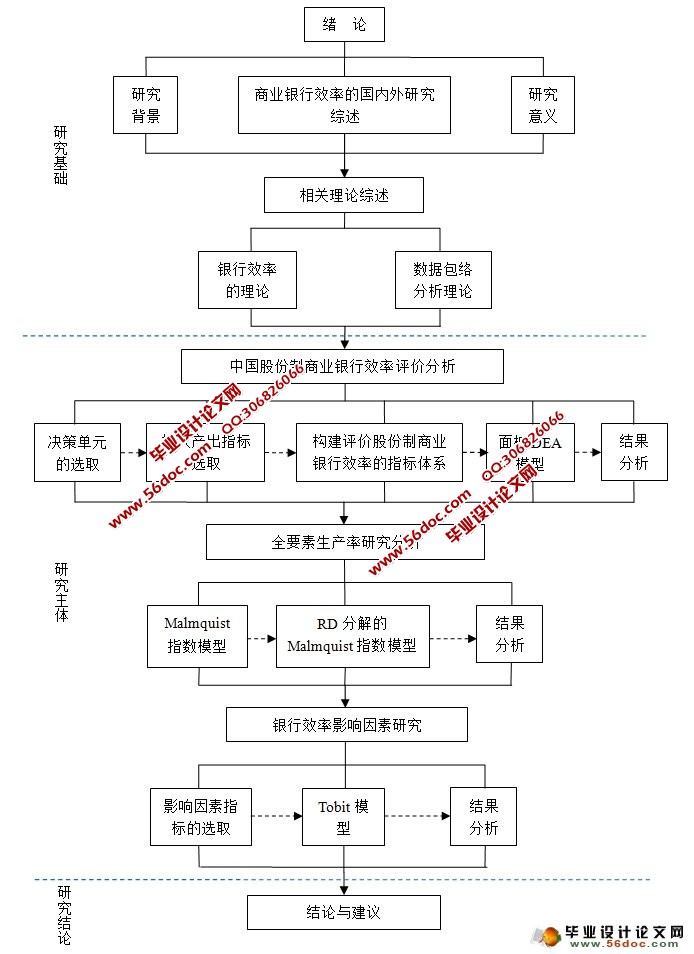

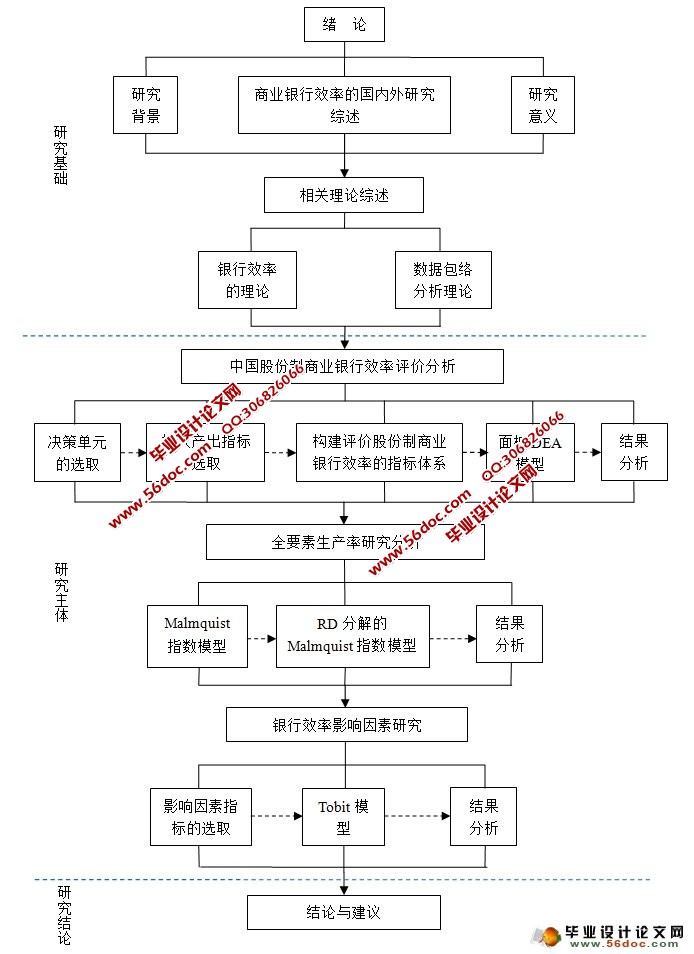

摘要:这段时间因为遭遇国际上经济发展运行背景的整体的左右,目前我国金融企业的相关金融工作面临着更大的挑战,在所有的金融机构里以股份制为主的侧重于商业的金融机构凭借它们独树一帜的金融特色以及与其他相比更加带有代表色彩的经济发展方式获得了更利于发展壮大的机遇,以股份制为主要内容的商业金融机构如果需要在当今各部门愈演愈烈的争夺中获得有力地位,重点在于要增强主要方面的运行能力,在这之中工作效率成为了相关部门主要竞争力的最具有代表性的体现,是评估金融机构日常运作效率的核心依据,工作的完成速度快慢客观的表现了以股份制为主的商业金融机构在日常工作活动之中,资金投入使用的效果和相关金融机构工作效率的高低。这篇文章大概利用中国十个以股份制为主商业金融机构看成分析对象,把2004到2014年总计十一个年份看成研究时间范围,使用通过面板数据的工作速度看作标准自静态的方式着眼归纳总结了起决策作用的金融机构在样本时间范围内的整体工作成效、科技利用率以及公司企业发展现状。然后,再利用把DEA看作标准的Malmquist发展形势,对样本时间范围内金融机构的各方面生产率增减变化情况和它的另外几项构成内容——科技利用效果、科技应用于日常工作所产生的积极效应以及金融机构发展情况作出了归纳总结,这样一来就可以更深层次地从各个方面考虑中国以股份制为主的商业金融机构工作运行的不同时期里的变化和状态。最后,通过随机效应Tobit模型针对左右我国以股份制为主的商业金融机构的整体工作状态、科学技术利用情况以及金融机构工作运行速度的相关原因做出了相应的解释和总结,指出了左右以股份制为主的商业金融机构工作效果发生变化的主要原因,对于未来金融机构创新规范以及未来提高金融机构的工作效率寻找到了积极有效科学合理的方式方法。

关键词:面板显示,相关数据总结(DEA),股份制金融机构,企业发展

Research on Efficiency and Influence Factors of Chinese Part of Joint Stock Commercial Banks Based on Panel Data Model

ABSTRACT

In recent years, due to the combined effects of the financial environment at home and abroad, the Chinese banking industry has been growing competition. If commercial banks want to win in the fierce and brutal competition, the key is to improve the core competitiveness. Efficiency is the concentrated expression of the bank's core competitiveness. To bank efficiency evaluation, it helps managers of commercial banks to clear itself in domestic and foreign banking sector, meanwhile, to recognize the gap between itself and other banks. Thus, it is a more targeted way to take measures to improve the operation and management, optimize the allocation of resources, realize effective management. Therefore, measuring the efficiency of Chinese commercial banks has a very important practical significance.

This paper selects 15 Chinese commercial banks as the study sample. From 2001 to 2009, it is a total of nine years as the study period. From a static perspective, it evaluates technical efficiency, pure technical efficiency and scale efficiency conditions of the sample banks based on panel data model (M- BEE). Later, This paper makes use of the DEA-based Malmquist index to calculate the total factor productivity and its three components - technical change index, purely technical efficiency change index and scale efficiency change index of sample banks. And it is a more comprehensive analysis of the cross time dynamic evolution of commercial banks efficiency in China. Finally, This article uses a random effects Tobit model for quantitative analysis. It researchs on the micro-impact factors of affecting Chinese commercial banks’ technical efficiency, pure technical efficiency and scale efficiency. As a result, it can clear the key factors of affecting efficiency changing, and find the improved direction for future.

The results show that the technical efficiency of 15 commercial banks have an increasing trend year by year over the past nine years. Pure technical efficiency presents the characteristics of first decreases and then increases further decreased. The scale efficiency rises slowly and does not change significantly. Chinese commercial banks presentes improvement trends in total factor productivity. Technological progress is the main driver of the increasing total factor productivity. The technical efficiency, pure technical efficiency and total factor productivity of the joint-stock banks are significantly higher than the level of the state-owned banks. EA and ER have a negative impact on the efficiency of commercial banks. For LQ, LD, INO and ROA, there is a significant positive promoting role in the technical efficiency and pure technical efficiency. In addition, correlation coefficient of ROA is the largest, followed by the ER and LQ. It showes that improving the bank's profitability, reducing operating costs and enhancing the quality of assets can significantly enhance bank's efficiency level.

KEYWORDS:Panel Data, Data Envelopment Analysis, Bank Efficiency, Malmquist Index, Effect Factors

目录

目录 IV

第一章 绪论 1

1.1研究背景 1

1.2 研究意义 1

1.3 研究现状与综述 2

1.3.1 国外商业银行效率研究综述 2

1.3.2 国内商业银行效率研究综述 3

1.4 研究的主要内容及方法 6

第二章 相关理论综述 10

2.1银行效率的理论 10

2.2 数据包络分析理论 10

2.2.1 C2R与BC2模型 11

2.2.2 DEA评价效率的经济含义 11

2.2.3 基于面板数据的DEA模型——中国股份制商业银行经济效益评价 12

第三章 基于面板数据的中国股份制商业银行效率评价分析 15

3.1决策单元的选取 15

3.2投入产出指标选取的方法 15

3.2.1 生产法 15

3.2.2 中介法 15

3.2.3 资产法 16

3.3构建评价中国股份制商业银行效率的指标体系 16

3.4结果分析 17

第四章 中国股份制商业银行全要素生产率研究分析 18

4.1Malmquist指数模型 18

4.1.1 Malmquist指数的定义 18

4.1.3 Malmquist指数及其组成部分的经济含义 19

4.2中国股份制商业银行全要素生产率评价与分析 19

4.2.1 Malmquist指数FGNZ分解与RD分解的计算结果比较 20

4.2.2 中国股份制商业银行总体效率变化分析 20

4.3小结 25

第五章 中国股份制商业银行效率影响因素研究 26

5.1影响因素指标的选取 26

5.2模型的设定 28

5.3计算结果分析 29

5.4小结 32

第六章 结论与建议 34

参考文献 36

|